Today marked a historic milestone with Brightline’s groundbreaking ceremony for its highly anticipated high-speed rail…

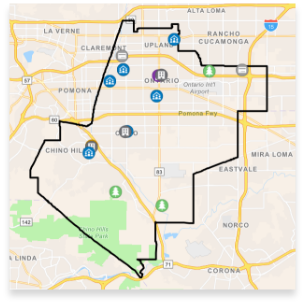

Welcome to the Fourth District

The Fourth District is located on the west end of San Bernardino County and has over 450,000 residents. I am proud to serve the constituents of the cities of Chino, Chino Hills, Montclair, Ontario, and Upland. This portion of the County is a vibrant region with a variety of activities and amenities. Residents and visitors alike can take advantage of the close proximity to Ontario Airport and plan a visit to Ontario Mills Mall or Toyota Arena in Ontario, spend a lazy afternoon at Prado Park or the Planes of Fame Museum at Chino Airport in Chino, take a hike at Chino Hills State Park or tour the remarkable BAPS Indian Temple complex in Chino Hills. Catch a concert at The Canyon Theater at Montclair Place in Montclair or a play at The Grove Theatre in the beautiful historical downtown Upland. As your county representative for the Fourth District, I am committed to serving my constituents while ensuring a safe and enhanced quality of life.

Email me with any questions, comments, or concerns. Your interests and feedback are important.

Sign up to receive more information about the Fourth District via email, and you’ll be the first to know about the open houses, events, and much more.

News

Media

View images of Supervisor Hagman and the Fourth District team attending meetings and community events.

View videos of Supervisor Hagman highlighting the Fourth District, honoring distinguished businesses, and attending community events.

My Priorities

Economic Growth

Infrastracture

Public Safety

Innovation

Discover More